What we are doing in response to the introduction of Japan’s Stewardship Code

Our firm has been fully on board with the aims of the code since we announced its adoption in May 2014. In November 2017, we have also expressed our decision to accept in its entirety, the revisions to the code made in May 2017.

We have been committed to our investment philosophy based around the central tenet that all securities have an intrinsic value with which market price converges in the medium-to long-term since we began investing in 1993. Our source of excess returns lies in enhancing enterprise value and contributing to sustainable growth of the investee companies. We believe that this dedication to achieving investment returns for clients and their beneficiaries in the medium-to long-term aligns us closely with the principles of Japan’s Stewardship Code.

As a firm, we are constantly striving to provide clients with superior quality asset building products and services--a stance which synergizes seamlessly with the aims of the code.

By voluntarily opting to adopt the code and follow its seven principles, we aim to enhance our contribution to our clients, as well as society as a whole.

- Principle 1

- Institutional investors should have a clear policy on how they will fulfill their stewardship responsibilities, and publicly disclose it.

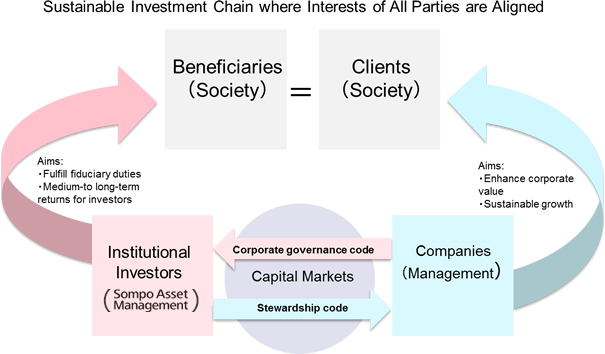

- Our mission is to maximize investment returns on client assets we manage by investing in listed companies. In order to fulfil our fiduciary duties as an asset management firm, we also acknowledge that as an institutional investor, one of our stewardship responsibilities is to act as one end of the investment chain. This is a chain which must contribute to the sustainable development of the investee companies, as well as society and the economy as a whole.

- We have taken the initiative to formulate and publicize our Sompo Asset Management Responsible Investment Policy, a code of conduct addressing our responsibility to society.

- This code clearly states both how we view our responsibility to society and what we expect from the investee companies. It also provides a roadmap detailing how we are fulfilling our stewardship responsibilities in the form of concrete investment processes and examples of engagement with companies.

In following this Rationale and Code of Conduct as a Responsible Investor, our firm is committed to helping our clients and beneficiaries to build their assets in the medium-to long-term.

- Principle 1 Relations between Institutional Investors and Companies

- Principle 2

- Institutional investors should have a clear policy on how they manage conflicts of interest in fulfilling their stewardship responsibilities and publicly disclose it.

- We have appropriate management and compliance frameworks in place to ensure that our clients and their beneficiaries are not impacted by conflicts of interest as a result of our trading and other activities.

We always aim to act in the best interest of our clients and beneficiaries above all else. In order to achieve this, our management and compliance frameworks identify the following types of possible conflicts of interest and the plan of action illustrating how to manage each. - (1)Conflicts of interest concerning investment in securities issued by parent companies and group companies

(2)Conflicts of interest concerning investment in securities issued by business partner companies

(3)Conflicts of interest concerning the exercise of voting rights

(4)Other conflicts of interest - ①Conflicts of interest between our business partners and client assets

②Conflict of interests between customer assets and other clients' assets

③Conflicts of interest between the Company and its management and client assets - To ensure conflict of interest management is carried out effectively in line with the policy, in addition to internal control frameworks and monitoring by our Compliance and Risk Management Department, our customer first committee, which is attended by external experts, also plays an important role in monitoring conflicts of interest.

- The committee reports its findings and proposals to the board of directors, who then provide the necessary oversight and instruction to ensure that client interests are considered above anything else.

- Principle 3

- Institutional investors should monitor investee companies so that they can appropriately fulfill their stewardship responsibilities with an orientation towards the sustainable growth of the companies.

- As an institutional investor, one of our social missions is to provide active asset management with awareness of our role as a responsible investor. We have been fully dedicated to and aligned with this mission since our firm was founded and continue to engage in active asset management with a focus on medium-to long-term intrinsic value of equities.

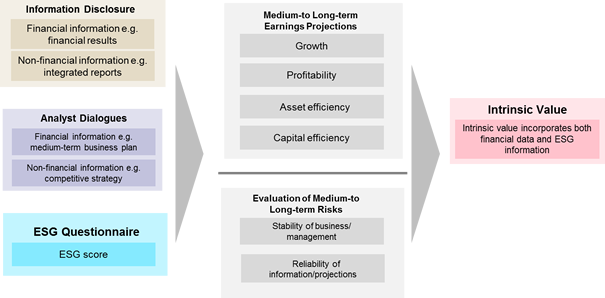

- Accurately identifying the intrinsic value of a company is crucial to this active management approach.

- In order to make sure our valuation process is appropriate we have put in place a robust in-house research engine powered by an elite team of analysts who meticulously analyze financial and non-financial company data to formulate medium-to long-term forecasts.

- At the core of this analysis lie three central components which make up a company’s intrinsic value: medium-to long-term profitability, key company financials, and capital policy. To capture this essential data we look at the competitive environment within industries, unique and competitive advantages and position and negotiating power in the value chain, as well as overarching factors like the macro economy all on a global scale. This is combined with ESG-related information with the potential to greatly influence future profitability and growth to build up a picture of a company’s potential and risk profile. We also examine the sustainability and stability of the balance sheet to validate and maintain consistency across forecasts.

- We continually perform this kind of analysis and calculate intrinsic value for all companies in our investment universe, not only those we are currently invested in. Our firm is committed to acknowledging our stewardship duties to companies we invest in, companies our analysts cover, and the wider capital markets and will endeavor to continue to provide high quality active management products and services.

- Principle 3 Appraisal of Intrinsic Value Based on Accurately Understanding Companies

- Principle 4

- Institutional investors should seek to arrive at an understanding in common with investee companies and work to solve problems through constructive engagement with investee companies.

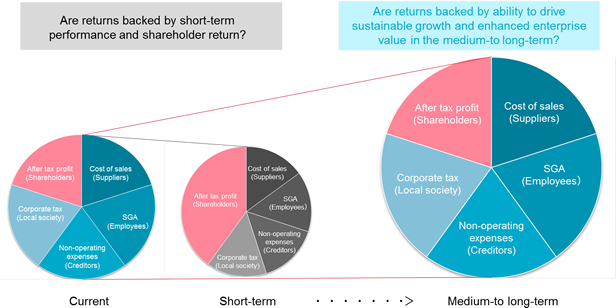

- Our mission is to utilize investor capital to maximum efficiency to enhance the enterprise value and promote sustainable growth at the investee companies and cover. At the same time, management of these companies also have a duty to run them in a way that is fair to shareholders, while at the same time contributing to the sound development of society and the wider economy.

- For this reason, as part of our engagement process we place great emphasis on understanding the value add and distribution processes at each company we cover. During this process we focus on initiatives targeting the common goals of enhancing enterprise value and fostering sustainable growth. This kind of approach enables us to engage in pertinent and constructive dialogues with companies.

- In order to make sure this engagement is as mutually beneficial as possible we first ensure that the companies we deal with fully understand our investment philosophy, processes, and criteria. Based on this knowledge, we then work closely with them on an ongoing basis to develop a deep relationship which we build on through focused, productive meetings with management to identify issues.

We also actively provide companies with feedback on topics such as the rationale for assigning a certain intrinsic value. - Using our vast industry and corporate investment experience, we aim to engage with companies on a level that is rewarding and meaningful for all parties involved.

- Principle 4 Engagement and Dialogue—Institutional Investor Interests Aligned with Companies

- Principle 5

- Institutional investors should have a clear policy on the voting and disclosure of voting activity. The policy on voting should not be comprised only of a mechanical checklist; it should be designed to contribute to the sustainable growth of investee companies.

- Institutional investors should have a clear policy on the voting and disclosure of voting activity. The policy on voting should not be comprised only of a mechanical checklist; it should be designed to contribute to the sustainable growth of investee companies.

- As mentioned previously, we see voting rights as a valuable part of our investing toolkit which must be used only to realize the interests of our clients. In order to make sure they are used correctly, we have created a set of guidelines which is available in English on our website.

- These guidelines state that the firm should, after full consideration of all individual items, vote either for or against that item. They do not permit us to either abstain from voting or cast blank votes. The guidelines also state that an items effect on shareholder value should be the only criteria for determining how to vote.

- Our firm seeks to use its voting rights to enhance enterprise value, contribute to sustainable growth of the investee companies and to realize medium-to long-term interests of our clients.

When making decisions on voting, our team uses a combination of qualitative and quantitative data backed up by records of their various contact with companies in order to prevent purely uniform or formulaic decisions. - Although we may incorporate objective use of additional information and third-party reports, the final voting decision will always lie with the firm.

- By feeding back the rationale and intentions behind the way we vote directly to investee companies, we create a platform to engage with each company and help it to grow sustainably. In addition to this, we also show how we are utilizing proxy voting to fulfill our stewardship responsibility by making our voting reports for each company and proposal available to the public.

- Principle 6

- Institutional investors in principle should report periodically on how they fulfill their stewardship responsibilities, including their voting responsibilities, to their clients and beneficiaries.

- Through our research and engagement we build up a picture of a company’s intrinsic value in the medium-to long-term. By selecting stocks as a result of our thorough investment process, we believe that the way we fulfill our stewardship duties is through active investing itself. We deem that reporting on our stewardship activities is a fundamental part of our investment reports. We release reports tailored to different client types and requirements and release on a regular basis.

- These detailed reports, which we send directly to investors and make available online, feature accessible information about what we are doing to fulfil our stewardship responsibilities, including data on how we used our voting rights. Content-oriented, they do not stop at simply superficial information such as the type and number of meetings with any particular company. Rather, we aim to release reports that look at how we are enhancing enterprise value and promoting growth at the investee companies, as well as why we assign them a certain value to make it clear what role our investing activities play in fulfilling our stewardship responsibilities.

- What’s more, by regularly sharing and collating information pertinent to stewardship within our investment team we have created an environment where exchange of ideas and opinions promotes further development of the area. Similarly, we also welcome client feedback, and are continually searching for ways to take on board ideas and advice to further enhance our stewardship activities.

- Principle 7

- To contribute positively to the sustainable growth of investee companies, institutional investors should have in-depth knowledge of the investee companies and their business environment and skills and resources needed to appropriately engage with the companies and make proper judgments in fulfilling their stewardship activities.

- For us, appropriately engaging with companies and making proper judgments in fulfilling their stewardship activities involves putting our expertise, experience, and team to work deriving appropriate medium-to long-term intrinsic values for the companies we cover. This is at the heart of our active management style and forms the source of investment performance.

- In order to make this possible, we are constantly taking steps to make sure our investment system is robust and that our people are working to the best of their abilities. Our investment system combines the individual expertise of our analysts and fund managers with tried and tested fundamentals analysis methods and valuation models. The result is a unified, stable environment that creates positive feedback loops on an individual and organizational level which in turn enable our team to continually grow building on their skills and knowledge.

- Fulfilling our stewardship responsibilities by providing high quality active management is part of our social mission as an active manager. That's why our management addresses the structure and staffing of the firm as two of the most important issues.

- Our firm has adopted and is signatory to the United Nations-backed Principles for Responsible Investment (PRI) and the Japanese Ministry of the Environment’s Principles for Financial Action in the 21st Century, a set of principles aimed at building a more sustainable society. We are also a signatory to the Montreal Carbon Pledge, an initiative aimed at reducing carbon footprint. In April 2017 we set up Responsible Investment Office to handle the firm's stewardship activities and planning, also creating a new role of ESG specialist for the office. Going forward, our ESG specialist and these advanced global initiatives will give our firm an opportunity to learn and bring back ideas to further its own stewardship activities.

- From 2016 we have been publishing our periodic stewardship activity report. This document both gives readers an insight into stewardship activities at the firm, as well as forming part of the overview of the results and evaluation of the effectiveness of our initiatives and any issues to address therein. We use this report to continually evaluate our stewardship activities as part of a PDCA cycle.